Renters Insurance in and around Cleveland

Welcome, home & apartment renters of Cleveland!

Rent wisely with insurance from State Farm

Would you like to create a personalized renters quote?

Insure What You Own While You Lease A Home

No matter what you're considering as you rent a home - utilities, internet access, number of bedrooms, house or condo - getting the right insurance can be important in the event of the unexpected.

Welcome, home & apartment renters of Cleveland!

Rent wisely with insurance from State Farm

There's No Place Like Home

When the unpredicted theft happens to your rented apartment or townhome, generally it affects your personal belongings, such as a set of favorite books, a microwave or a stereo. That's where your renters insurance comes in. State Farm agent Tim Hough wants to help you understand your coverage options so that you can protect yourself from the unexpected.

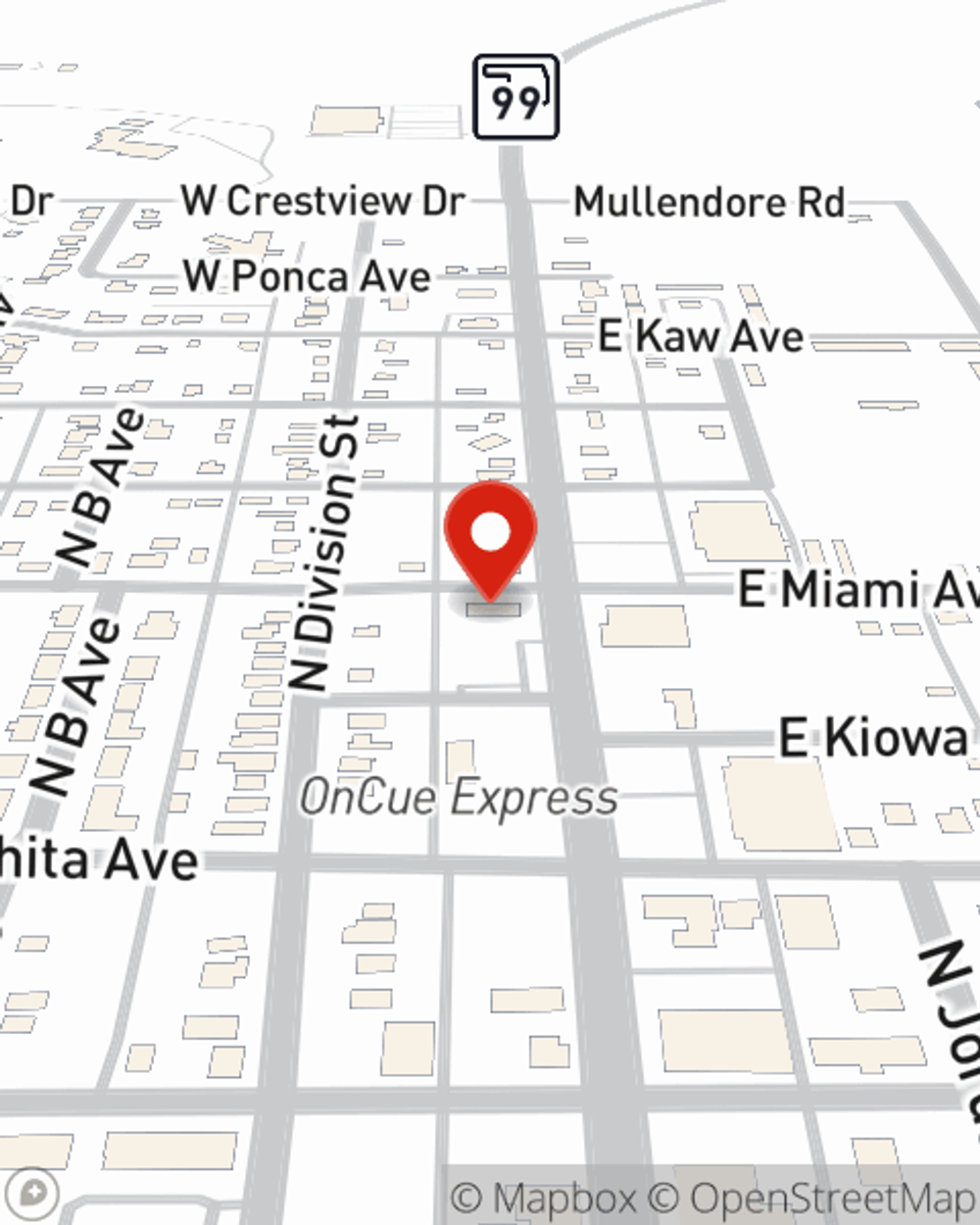

Reach out to State Farm Agent Tim Hough today to see how the trusted name for renters insurance can protect items in your home here in Cleveland, OK.

Have More Questions About Renters Insurance?

Call Tim at (918) 358-3535 or visit our FAQ page.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.

Simple Insights®

Common rental scams and landlord frauds

Common rental scams and landlord frauds

Rental and landlord scams are more common than you think. Learn ways to tell if a rental is legitimate and how to avoid apartment scams.

Tips for renting an apartment or a house

Tips for renting an apartment or a house

Here are some things to consider when renting an apartment to help you get ready before you move to your next rental property.